Founders Insurance Company is a member company of the Utica National Insurance Group. It began providing organizations with Liquor Liability insurance in 1959.

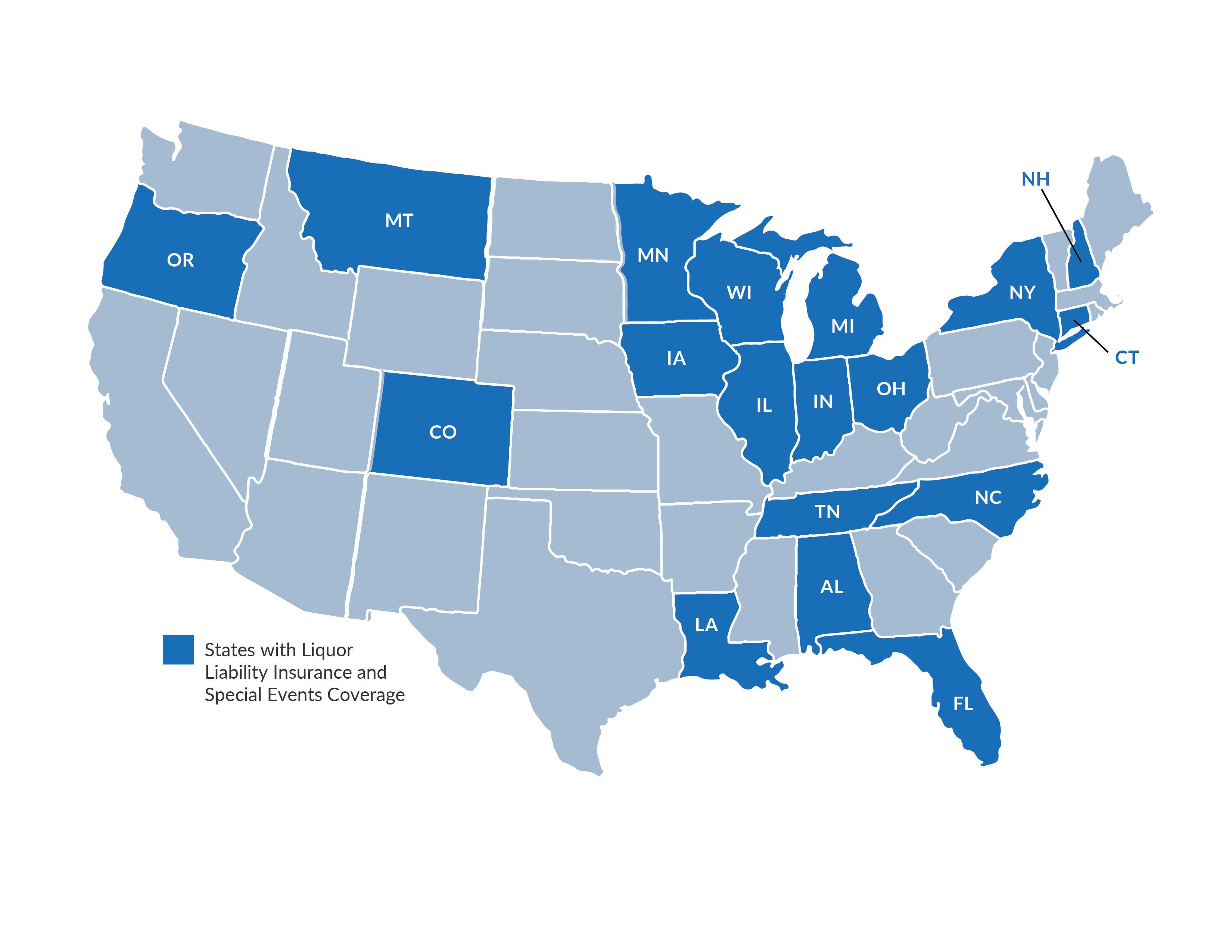

General liability policies typically do not cover liquor liability claims. Founders has been serving the hospitality industry for nearly six decades and proudly writes Liquor Liability Insurance and Special Events Coverage in 22 states, where we have in-depth knowledge of the state laws.

Liquor Liability Insurance Eligibility Includes:

- Bars and cocktail lounges

- Restaurants and banquet halls

- Comedy clubs and dinner theaters

- Billiard/pool halls and bowling alleys

- Fraternal organizations and social, civic, and private clubs

- Grocery stores, convenience stores and liquor stores

Coverage Features

- Policy limits up to $1 million per occurrence/$2 million aggregate

- Assault and battery coverage up to $1 million

- Flexibility in risk acceptance including:

- Late closings

- Prior claims

- New ventures

- Live entertainment

- Special events

Founders has an A+ rating by the Better Business Bureau and the Utica National Insurance Group is rated A- (Excellent) by A.M. Best Company*.

Agency Appointment

To pursue an agency partnership with Founders Insurance Company, contact Patrick Vaulman.

*Rating as of October 27, 2016

This is a summary of coverage and services. The precise coverage is subject to the actual terms and conditions of the insurance policy. Not all coverages are available in all states.